Real Estate Fact vs Fiction

Coastal Carolinas Housing Market Snapshot… Stability Returns

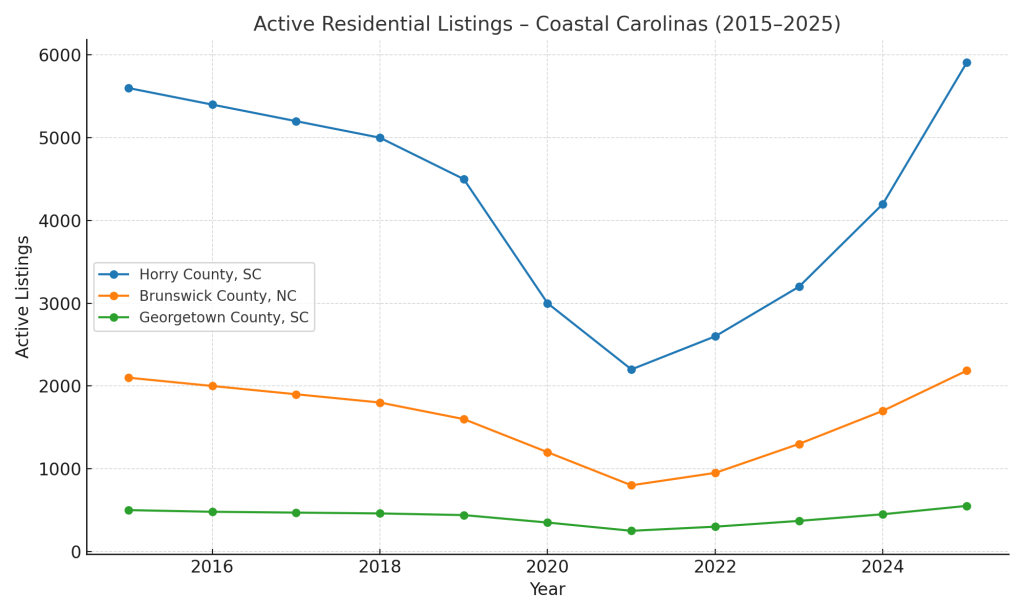

The Coastal Carolinas housing market is in a balanced, stable phase, far from the extremes of the 2008 housing crash or the record-low inventory frenzy during COVID. This report adds context to the current numbers and explains why headlines about “500,000 more sellers than buyers” are misleading.

The Coastal Carolinas housing market is in a balanced, stable phase, far from the extremes of the 2008 housing crash or the record-low inventory frenzy during COVID. This report adds context to the current numbers and explains why headlines about “500,000 more sellers than buyers” are misleading.

Why Context Matters

Numbers without context can lead to the wrong conclusion. National statistics alone do not tell the full story, especially when they compare today’s balanced market to the unusually high activity during COVID. Inventory levels are higher than the historic lows of 2020 through 2022, but they remain within healthy ranges and are nowhere near the oversupply that drove the 2008 housing crisis.

The Problem With the Buyer Estimate

The “500,000 more sellers than buyers” claim is built on a buyer estimate that is not an actual count of active buyers. Instead, it is based on a model that uses pending sales data combined with historical averages for how long it takes a buyer to move from a first tour to a signed contract.

This approach is not a precise measure of demand. It is a hypothetical estimate, and like any model, it is only as accurate as the assumptions behind it. Market conditions, local differences, and changes in buyer behavior make the national number unreliable when applied to a specific region.

Then vs. Now

- 2008 Crash: National inventory peaked near 4.6 million existing homes for sale with 9 to 10 months of supply, creating an oversupply that pushed prices down.

- COVID Frenzy (2020–2022): Inventory dropped to about 1.03 million homes with 1.6 to 2.0 months of supply, creating bidding wars and rapid price growth.

- Today: About 1.53 million homes for sale nationally with 4.7 months of supply, which is typical for a balanced and sustainable market.

Looking Ahead

Once the Federal Reserve begins reducing interest rates, the number of active buyers is expected to rise quickly. Many buyers who have been waiting on the sidelines will re-enter the market, which will absorb much of the current inventory. This makes now an excellent time to buy. Buyers today have more selection, less competition than during the COVID years, and the opportunity to negotiate more favorable terms before demand increases again.

Bottom Line

The current market is stable. The slowdown that some believe they see is the result of adjusting from the unusually fast pace of the COVID years, not a sign of trouble. Buyers have more choice, sellers still have steady demand, and prices are supported by a balanced supply of homes. National headlines may attract attention, but local data tells the true story. In the Coastal Carolinas, that story is one of stability and opportunity.

If you are looking for accurate information, be sure you are talking with a full-time Realtor who specializes in your market area.